W&C State of the Industry

The wall and ceiling industry seems to be holding consistent from last year’s results. But will it continue? Here are the highlights.

W&C recently conducted our annual State of the Industry study which went out to our subscribers. Where are we at as an industry at from last year and overall? Is labor still a challenge? What about the supply chain issue? What are the latest concerns our contractors, architects and distributors have today?

The purpose of the Walls & Ceilings State of the Industry Study is to identify current business conditions, trends and issues in the wall and ceiling industry. Clear Seas Research, in conjunction with W&C, has again conducted the SOI Study in order to obtain detailed information on industry professionals’ outlook on the wall and ceiling industry as a whole.

Specifically, this research seeks to identify:

- Influential factors and key challenges facing the industry

- Change in product sales for 2023 and into 2024

- Company information including number of employees and gross annual sales

- Demographic profile of wall and ceiling industry professionals

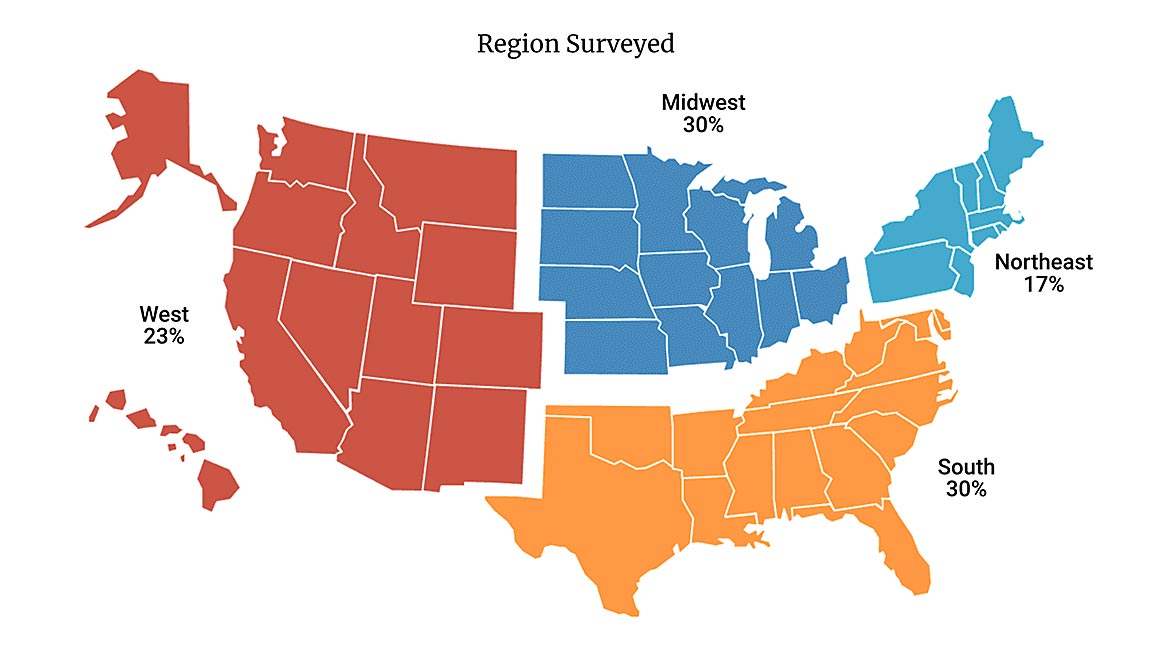

Out of those surveyed, 53 percent identified as subcontractors; 24 percent architects and 5 percent distributors. Regionally, the survey was divided up into four regions: the West (including Alaska and Hawaii); South; Midwest, and Northeast.

The majority of commercial business revenue comes from new construction, while residential business revenue is split relatively evenly between new construction and repair.

- Commercial new construction: 27 percent

- Commercial new repair/remodeling: 24 percent

- Residential repair/remodeling: 26 percent

- Residential new construction: 18 percent

Overall Business Conditions

Almost half of respondents report an increase in 2023 annual revenue, compared to 2022, with an even greater proportion of respondents expecting growth in the next two years.

Almost all respondents indicate the cost of doing business will increase in 2024 as compared to 2023.

The majority of respondents indicate the current economy, increased building material costs, labor costs, and lack of qualified workers are major issues for their business in 2024. Nearly one-third chose the current economy as their single greatest business challenge.

Approximately three-quarters of respondents’ companies conduct in-house training. Field, design/build, and safety training are typically conducted in-house only.

Sales

More than two-in-five companies expect 2024 sales to increase compared to 2023, with an average expected increase of 15 percent.

Drywall, insulation, and ceilings are the most frequent product categories respondents are involved with and account for nearly half of sales revenue, on average.

Over four-in-five respondents indicate an increase in material pricing over the past 12 months.

Employee and Retention Information

On average, responding companies have a median of 10 full-time employees and one part-time employee. Thirty-seven percent of companies do not have part-time employees.

Over half of respondents indicate the number of employees at their company in 2023 has remained the same, however, more than one-third believe that in 2024 the number of employees at their company will increase.

More than half of respondents agree the future of the “specialty contractor” is promising, while more than two-in-five are moving towards using more prefabricated systems and/or expect to see a significant shift in how they build.

More than one-third of companies have sought out new employees via job boards, increased current employee duties/responsibilities, and/or gave out referral bonuses to retain and/or hire new employees. In order to attract younger generations, respondents indicate they are offering competitive wages/benefits, providing training/mentoring, recruiting at schools/job fairs, and offering flexible work hours/ability to work remotely.

Industry Opinions and Actions

Economic conditions, finding qualified workers, and material costs are expected to be the most influential factors in 2024.

As it was last year, labor issues are most likely to be the greatest challenge for companies within the wall and ceiling industry in 2024. Prefabrication, automation/robotics, and BIM are promising for the future of the industry.

Technology Adoption

Accounting software and labor-related software are the most commonly used types of software currently.

The majority of respondents report their company has an online presence, with 71 percent indicating that their company has its own website. Around half indicate a LinkedIn and/or Facebook presence, as well.

New Products/Services

New products/services respondents’ companies are planning to offer in the next 24 months include a variety of building materials and products, design offerings, construction services, software, and insulation among other offerings.

- Coatings

- Mud-in devices (lights, fans, speakers, HVAC vents)

- Acrylic-based liquid-applied flashing material

- Shades, lighting

- Wall components

- Architectural design

- Hospitality design services

- Interior design

- Traditional client-oriented design services

- Custom casework

- Expand into the sales and construction of ADUs

- Water damage restoration

- 3-D scanning, drone imaging

- Automation

- BIM

- Interior cloud point scanning

- New software integrations for camera solutions

- Robotic layout tools

- Smart home products

- EIFS/stucco

- Exterior wood fiber insulation

- Spray foam insulation

- Exterior finishes

- Air barriers

- Cement siding

- Concrete

- ICFs

- Fiber cement, acoustical ceiling tiles, interior wall finishes

- Metal ceilings

- Soundproofing

- Monolithic acoustical solutions

- Online education system

- Window replacement

- Prefabrication

Most Promising Technology/Development

When those surveyed were asked what products/technology were considered to be on their radar, many supplied written responses. Among those that were referenced are:

- Prefabrication/Panelization

- Automation/Robotics

- BIM

- Artificial Intelligence

- Insulation

- Estimation/Project Management Software

- 3-D Modeling

- Laser Scanning

- Light-weight Materials

- Acoustics

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!